What is a power of attorney?

A power of attorney is an attorney-in-fact document in which a person grants another the power and authority to act in their place. The grantor gives the grantee power and authority in all matters except for those specifically reserved by law.

A power of attorney allows for someone to make decisions on behalf of another person. The power can be either general or specific, and it is granted for a specific duration. An elder law power of attorney is a legal document that appoints another person to be the legal guardian of your assets.

An elder law power of attorney can be useful when you want to get rid of the old and get into a new phase in life, such as getting married, starting a new family, moving away from assisted living, etc.

By appointing someone else to be your guardian while you are still alive and healthy, you will not have to worry about what your next move might be and can enjoy your life.

Why might some want to get power of attorney from their parents?

Many people may not know that many states and countries have a power of attorney laws and procedures.

While these laws vary by state and country, the basic idea is to allow a person to speak on behalf of another, such as giving their parents power of attorney to make medical decisions for them.

Furthermore, some people may be reluctant to sign a legally binding document such as a will or trust because they don't want to lose control over their assets. In these cases, giving the power of attorney can help ensure that those assets are ultimately distributed as they wish.

How can getting power of attorney help them and an elder parent?

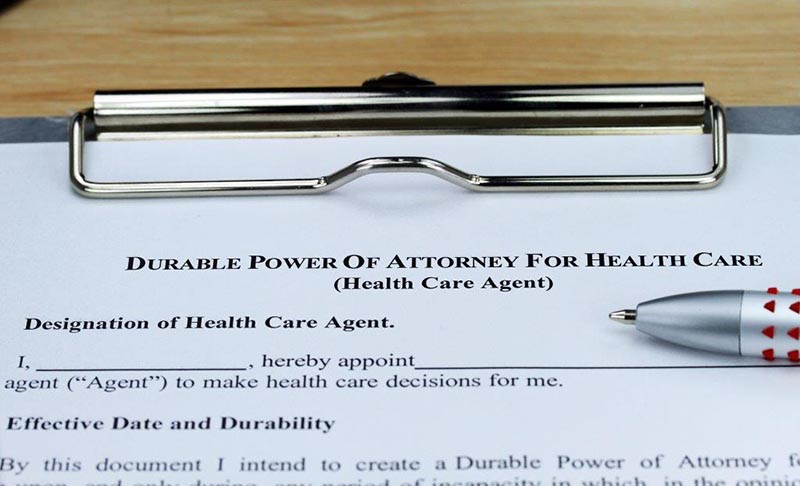

Power of attorney, also known as durable power of attorney for health care, gives someone else the ability to make decisions about your health care. If you are not able to make your own decisions or if you want someone to take care of your finances or property when you are unable to do that, then it is time for you to consider getting this power of attorney.

A power of attorney can be beneficial in many situations. It can allow you and your elder parent the freedom and control over their lives when they are in need of help. However, it is important to know what kind of power an agent will be given when they get this document so that the agent will not misuse the powers granted in the document.

How power of attorney can protect a person's family?

In the event of a loved one's passing, power of attorney can help ensure that your wishes are followed. In addition to this, it allows you to appoint someone else as your agent in order to handle finances, property, and more.

Power of attorney can provide peace of mind for many families. It ensures that all your wishes are carried out after you pass away or become incapacitated when it is executed properly.

When done correctly, power of attorney allows you to appoint an individual as your agent so that they can handle financial matters for you while also ensuring that your wishes are carried out after you die or become incapacitated.

How To handle obtaining power of attorney for parents?

An individual usually becomes an agent as either their own parents, children, spouse, or grandchildren. When they are raised as an heir to their family estate, they might become legally entitled to act on their parents' behalf.

When thinking about how to handle the process of obtaining a Power of Attorney for your parents, it is important to consider both what you and your family need and want from them and what risks can be mitigated by having them in this kind of position. The most common reason people want a POA is that they have the power to manage their finances.

The difference between power of attorney and inheritance trustee?

There is a difference between a power of attorney and an inheritance trustee.

- Power of Attorney: The person, or persons, is in charge of managing the assets and financial affairs of the person who has given the power of attorney. This includes paying bills, taxes and any other financial matters.

- Inheritance Trustee: The person who will be in charge of handling the assets and financial affairs for someone else. This includes allocating money to heirs as well as managing an estate plan for that person.

Does power of attorney include estate planning?

In general, power of attorney always includes estate planning. The term "estate planning" comprises many legal and financial terms. For example, in the power of attorney, it would include executing a will or an advance directive in case the holder of the power of attorney passes away.

The key difference between these two is that when we talk about execution in a will, we are talking about the transferral of property from one person to another, while when we talk about estate planning, we can also include such things as trust and arranging for healthcare.

Whom do you need to talk to if you are thinking of obtaining power of attorney for your parents?

On average, people around the world aged 80 or more are living longer. But this is not always the case. If you are the one who became unable to care for your sick parents, you may need to prepare some legal documents for your parents. Whether it is your parent or parents - they need to have some form of power of attorney first before you can apply for one on their behalf. They will give this in some form but usually includes a durable power of attorney, which refers back to their will and living trust. Getting in touch with a local law firm that specialises in estate planning and inheritance should be a great help to discover more about power of attorney.